capital gains tax proposal details

It includes major revisions to the estate tax capital gains taxes and the way retirement accounts are taxed. Backdoor Roth IRAs would be prohibited for high earners.

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Under the proposal the new top rate on capital gains could be as high as 318 when combined with the surtax and an existing 38 investment income tax.

. President-elect Joe Bidens Tax Proposals October 2020 Update Key Findings President-elect Joe Biden according to the tax plan he released before the election would enact a number of policies that would raise taxes on individuals with income above 400000 including raising individual income capital gains and payroll taxes. Bidens campaign proposal regarding capital gainsthe details. Under the proposal a.

Taxes long-term capital gains and qualified dividends at the ordinary income tax rate of 396. If this happens it means they would be taxed at ordinary income tax rates as high as 396. The new tax would affect an estimated 58000 taxpayers in the first year.

The top capital gains tax rate would be 25. Assets given to charity would be exempt. Those earning income above 1 million would have their capital gainswhether short-term gains or long-term gainstaxed at 396 as well.

Presumably the date of announcement refers to late April when Biden first discussed his proposals. The release of the Biden administrations General Explanations of the Administrations Fiscal Year 2022 Revenue Proposals commonly known as the Green Book makes clear that capital gains are among the administrations top tax targets. The Green Book contains the following proposals.

Currently all long-term capital gains are taxed at 20. Here are the top 10 new tax-related changes in the 175 trillion tax and spending plan that Levine pointed to in his Twitter thread not. Sole proprietor income retirement accounts homes farms and forestry are exempt.

This legislation calls for increasing the top individual tax rate from 37 to 396 and raising the capital gains tax rate from 20 to 396 for taxpayers with incomes higher than 1 millionand even higher for those required to pay the net investment income tax. Roth IRA conversions including backdoor Roth IRAs would be prohibited for high earners. While the estate tax exemption at a little over 11 million per person exemption for capital gains tax would remain there would be the capital gains.

The first 1 million of unrealized gains 2 million for a married couple would be exempt from the new tax. Tax long-term capital gains as ordinary income for taxpayers with adjusted gross income above 1 million resulting in a top marginal rate of 434 percent when including the new top marginal rate of 396 percent and the 38 percent Net Investment Income Tax NIIT. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value.

Taxpayers with an income of over 1M could lose their preferential 20 treatment on long-term capital gains. Here are the details of Bidens plan to tax capital gains. The book which summarizes the tax proposals in Bidens proposed budget includes two broad proposals that.

Taxes long-term capital gains and qualified dividends at the ordinary income tax rate of 396 percent on income above 1 million and eliminates step-up in basis for capital gains taxation. The estate and gift tax would revert to pre-Trump levels. The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers.

Capital gains tax proposal details. The top capital gains tax rate would be 25. The estate tax would revert to pre-Trump levels.

Real estate or business interests would not be taxed annually Wyden said but billionaires would still pay a capital gains tax including. Taxes on assets transferred to a spouse would be deferred until the surviving spouse dies or sells the inherited assets. This proposal would be effective for gains required to be recognized after the date of announcement Observation.

The exemption would be indexed for inflation. Tax capital income for high-income earners at ordinary rates. Any gain would then in most cases be subject to long-term capital gains tax of up to 238 percent tax rate under current law.

Changes to International Tax. The proposed plan would also mean higher taxes on foreign income. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion.

President Biden on Monday unveiled a new minimum tax targeting billionaires as part of his 2023 budget request proposing a 20 rate that would hit both the income and unrealized capital gains of.

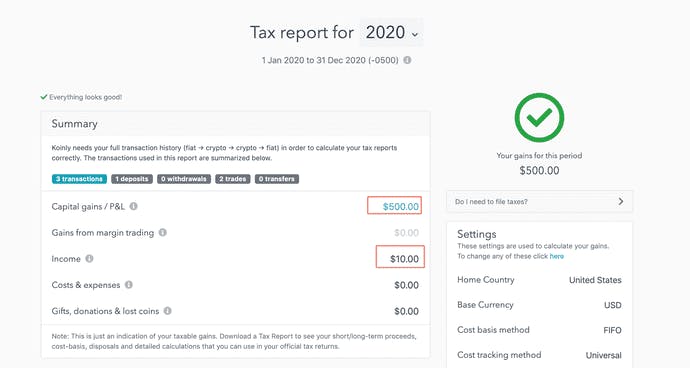

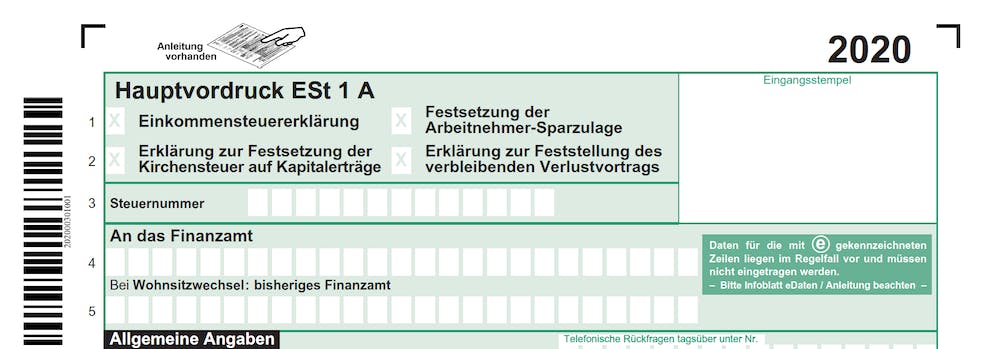

Germany Crypto Tax Guide 2022 Koinly

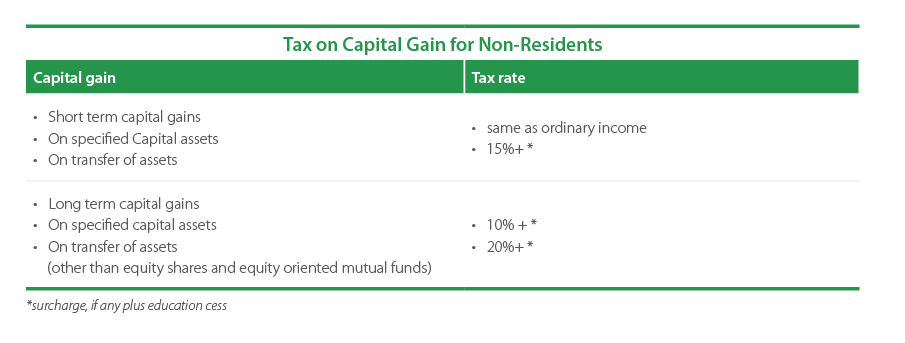

Do You Know The Answer Click To Know Http Ow Ly Psh930p93th Mmkuiz Mymoneykarma Creditcard Tax Deducted At Source Unsecured Credit Cards Tax Refund

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

All You Wanted To Know About Capital Gains Tax Capital Gains Tax Capital Gain Tax

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

How To Calculate Capital Gain Tax On Sale Of Land Abc Of Money

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

All About Capital Gains Tax How To Calculate Income From Capital Gains Indexation Concept Youtube

Mutual Funds Taxation Rules Fy 2020 21 Capital Gains Dividends

Like Kind Exchanges To Be Limited Under Biden S Tax Proposals Mortgage Rates House Prices Mortgage

Germany Crypto Tax Guide 2022 Koinly

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Capital Gains Tax Examples Low Incomes Tax Reform Group

Capital Gains Tax On Separation Low Incomes Tax Reform Group

What Hsn Sac Details To Be Declared In Gst Returns Invoices Accounting Services Filing Taxes Tax Services

Will Joe Biden S Proposed Taxes On Capital Make America An Outlier The Economist